Major Highlights of White paper on State Finances

• The Central Government and the previous State Government are responsible for the prevailing grim financial position of the state.

• The previous State Government incurred wasteful expenditure on celebration of “Amrit Mahotsav”, “Pragtisheel Himachal: Sthapna ke 75 Varsh” and “JAN Manch” which were used as a tool to publicize previous Government’s party programmes, prior to the 2022 Assembly election.

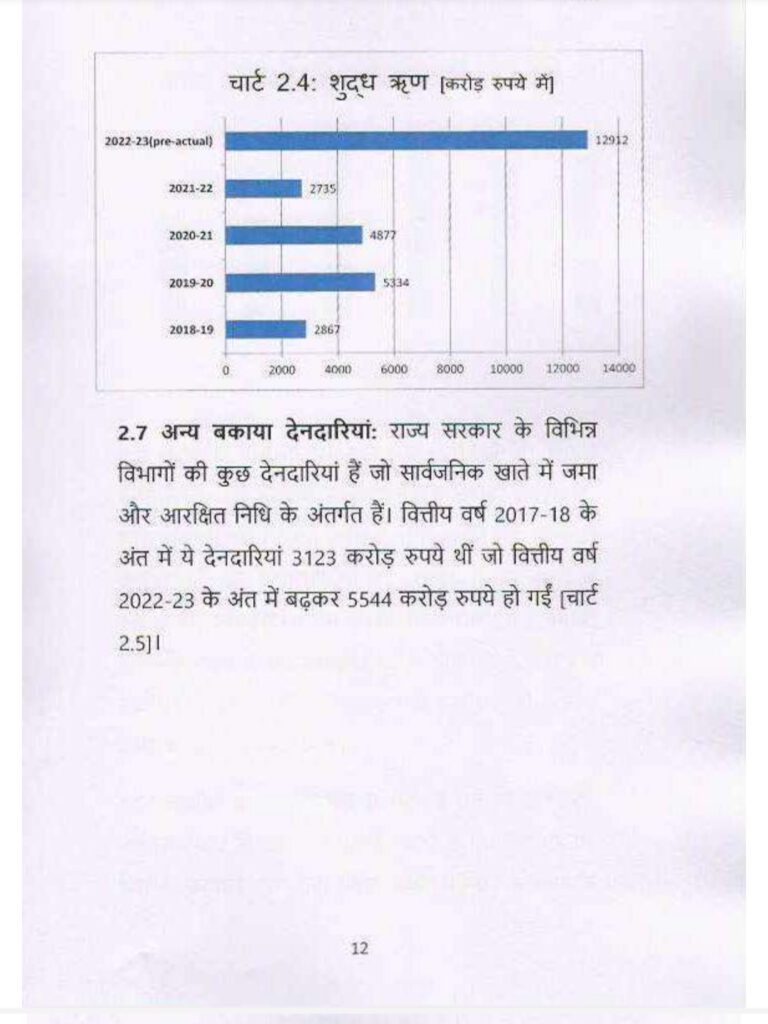

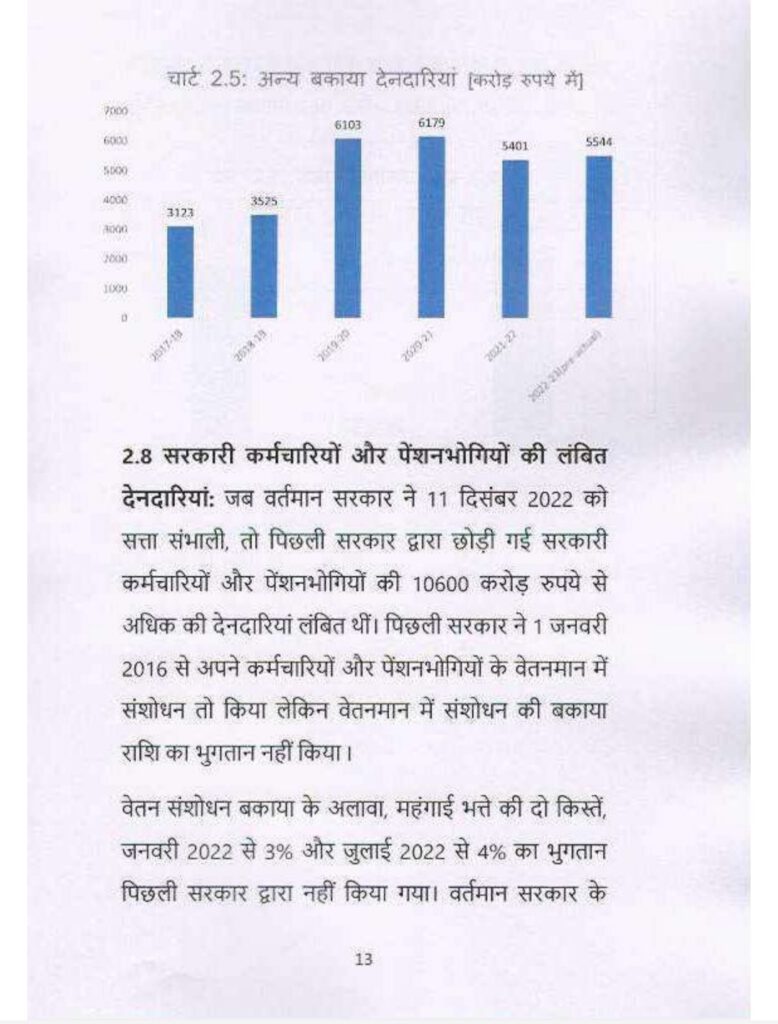

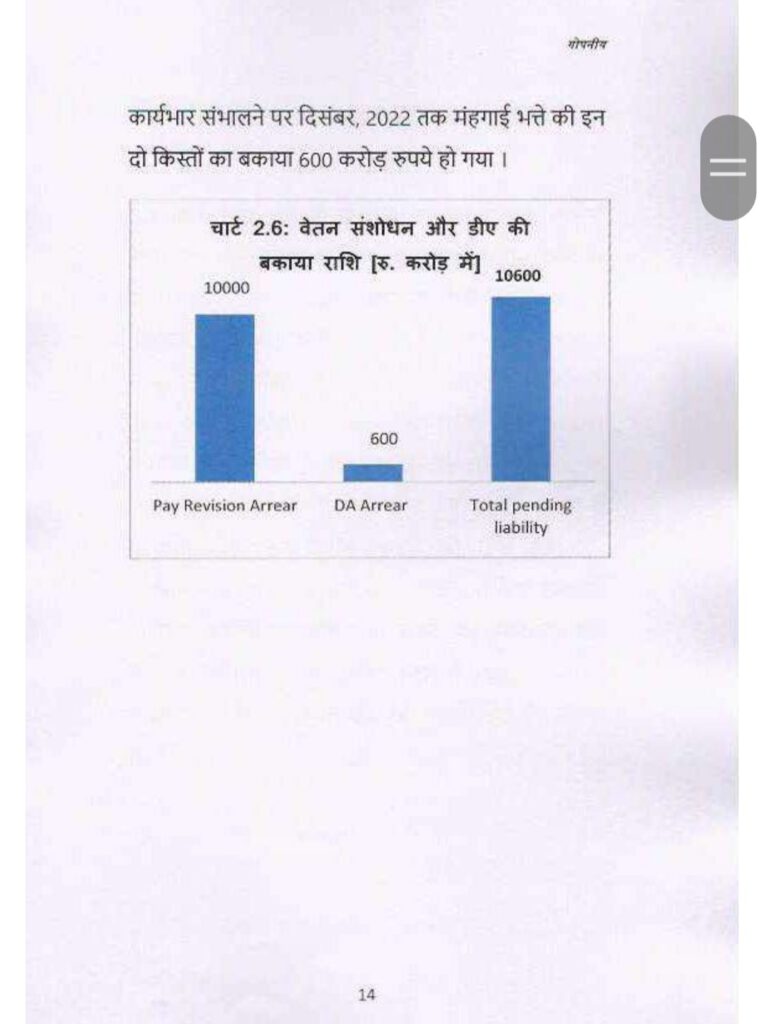

• Present Government inherited total direct liabilities of Rs.92,774 crore from the previous Government. These consist of debt of Rs.76,630 crore, other outstanding liabilities of Rs.5,544 crore in Public Account and about Rs.10,600 crore on account of pay revision and DA till December, 2022.

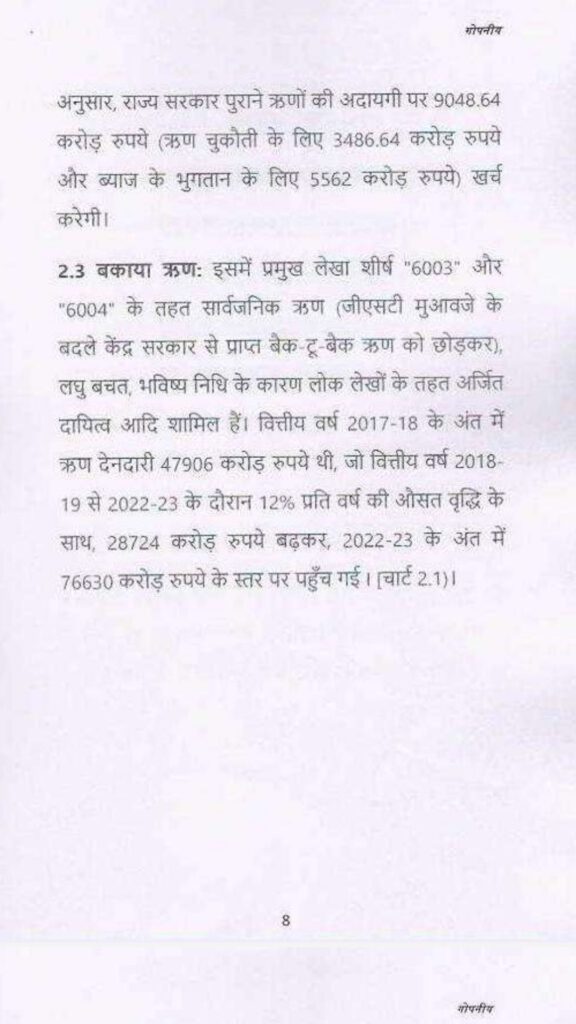

• Debt liability at the end of fiscal year 2017-18 was Rs.47906 crore which increased by Rs.28724 crore during the fiscal years 2018-19 to 2022-23 and reached Rs.76630 crore at the end of 2022-23.

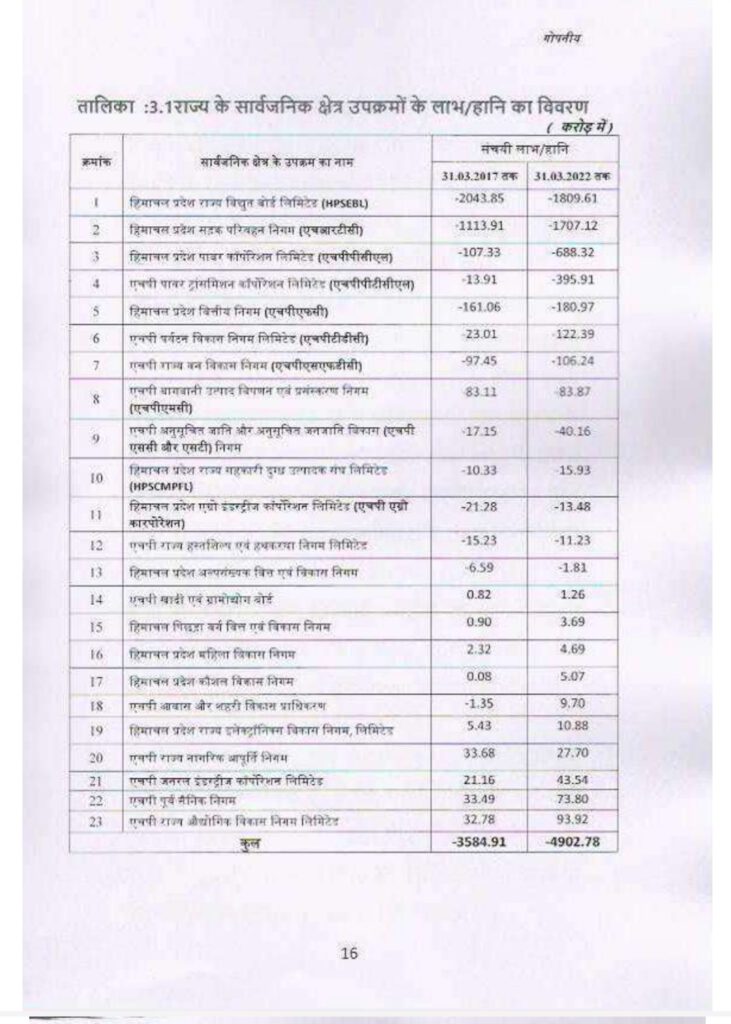

• As on 31 March 2017, cumulative loss of the state PSUs was Rs.3584.91 crore which increased to Rs.4902.78 Crore as on 31 March 2022, i.e. an increase of Rs.1317.87 crore (36.76%).

• Closure of the Planning Commission resulted in loss of around Rs.3,000 crore per annum of the Central Plan Assistance.

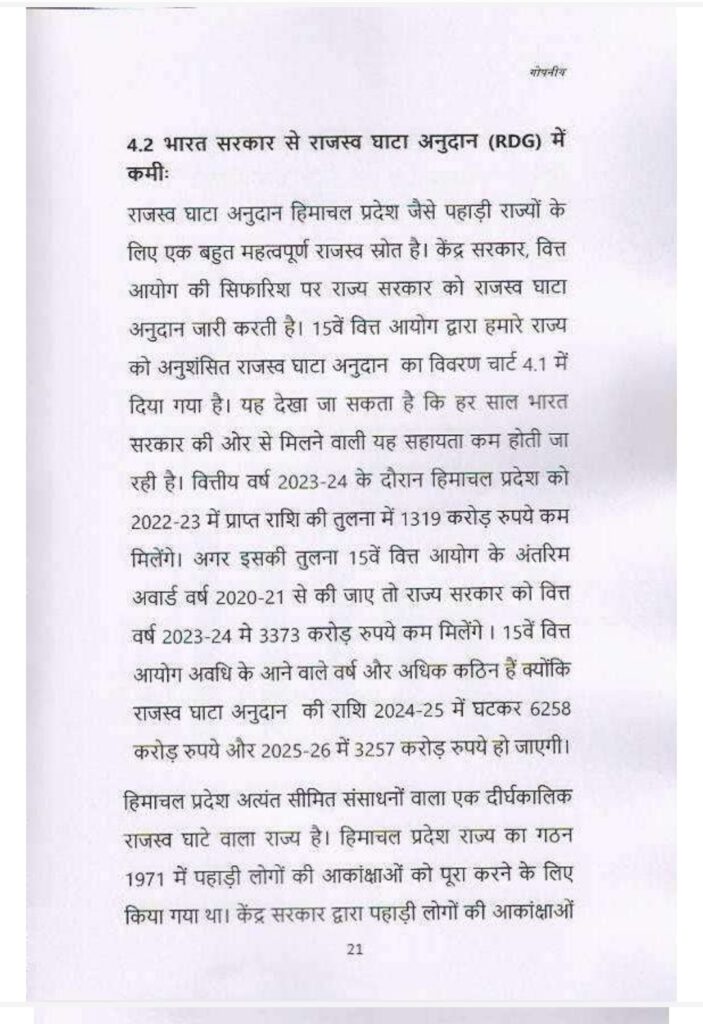

• During 2023-24, Himachal Pradesh will get Rs.1319 Cr less Revenue Deficit Grant (RDG) as compared to the amount received in 2022-23. Coming years are more crucial as the amount of RDG will be reduced to Rs.6258 Cr in 2024-25 and Rs.3257 Cr in 2025-26.

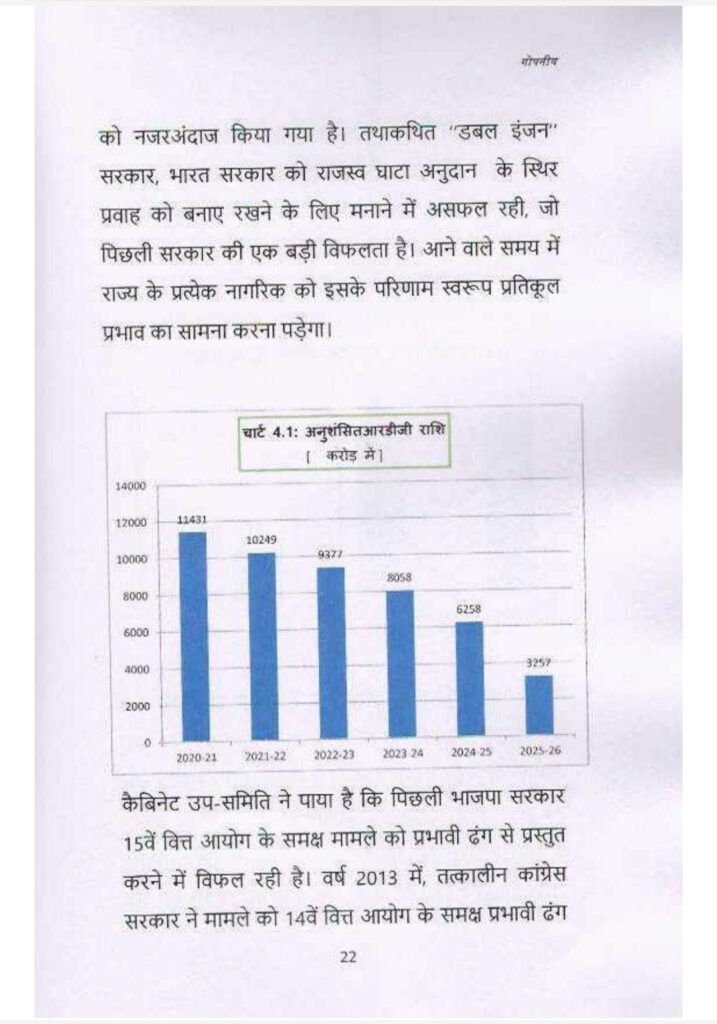

• The then Congress Government had presented the case before 14th Finance Commission effectively and got 232% hike in overall devolution of funds as compared to 13th Finance Commission, while the previous State Government was able to get hike of only 8% in the award given by the 15th Finance Commission over a five year period as compared to 14th Finance Commission.

• After cessation of the GST compensation in July 2022, the revenues of the State Government have reduced by around Rs 2624 crore per annum.

• The borrowing limit of the State Government has been reduced by the Central Government in 2023-24 viz-a-viz 2022-23 by Rs.2836 crore on account of reduction in borrowing ceiling and deduction on account of switching over from NPS to OPS.

• Government has taken up with Pension Fund Regulatory and Development Authority (PFRDA) for release of funds deposited under NPS by the State Government/Employees, amounting to over Rs 9000 crore, as the state Government has shifted from NPS to OPS.

• Ministry of Finance, Government of India has imposed a cap of Rs.2944 crore for availing External Assistance under Externally Aided Projects (EAPs) for new projects for three years period between 2023-24 to 2025-26.

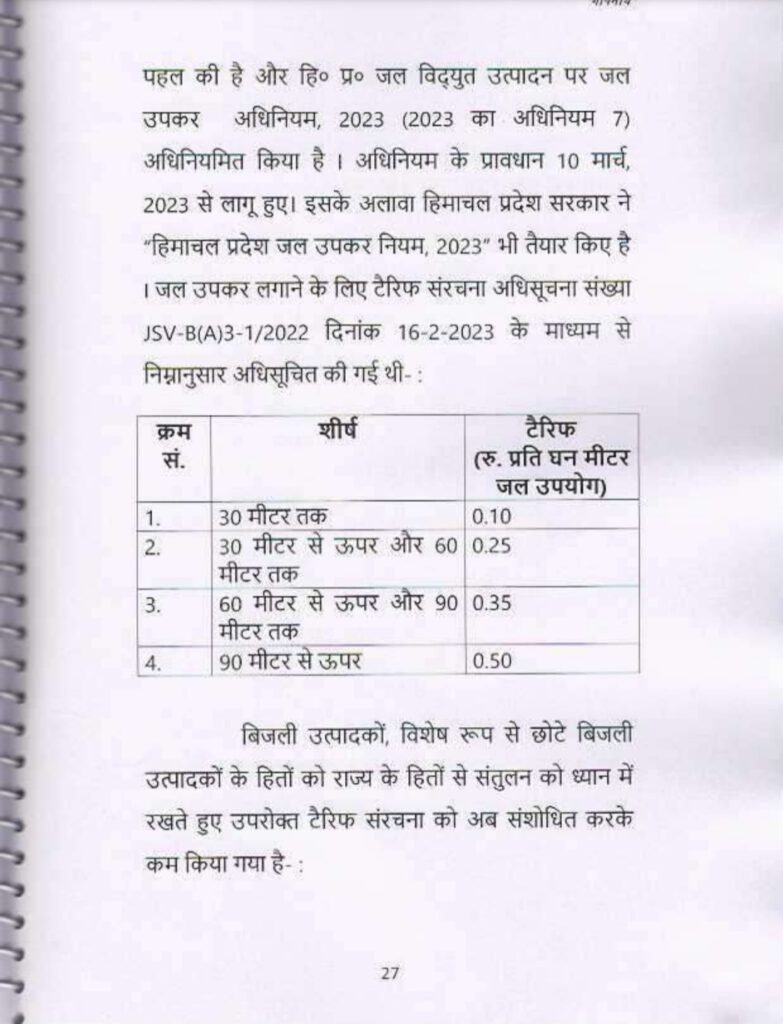

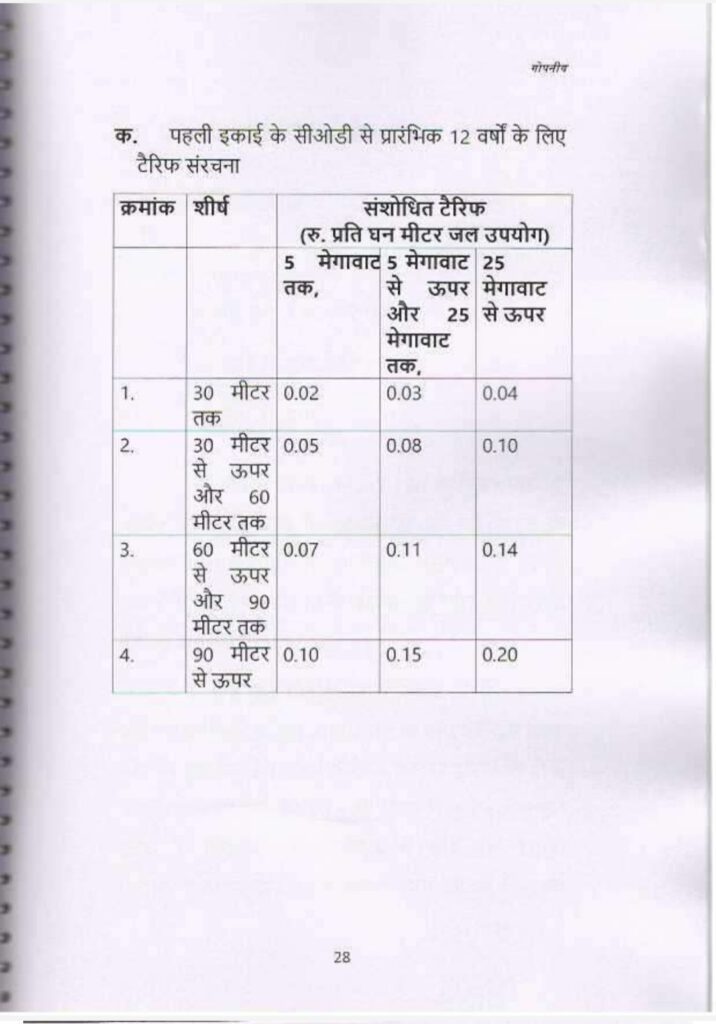

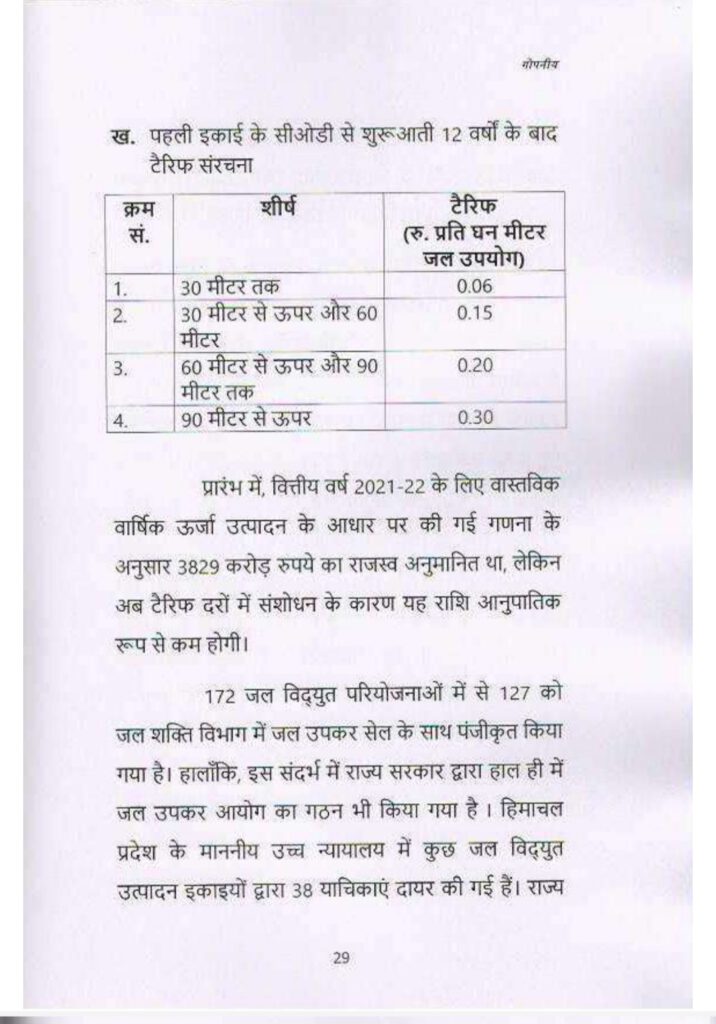

• The effort of Himachal Pradesh Government to increase its revenues through imposition of water cess has been objected to by the Central Government.

• 15th Finance Commission had recommended total amount of Rs.1420 crore i.e. Rs. 1000 crore for construction of green field airport Mandi , Rs. 400 crore for expansion of Kangra airport and Rs. 20 crore for Jawalamukhi temple town and adjoining areas. However, the Central Government has not released these to the State.

• Funds on account of 13,066 million units share accumulated from 1st November 1966 to 31st October 2011 are still pending for release to Himachal Pradesh, by BBMB. The previous Government didn’t take any concrete steps for release of this share amounting to Rs 3309.48 crore and the matter is still pending with the Supreme Court.

• Announcement of the 70 National Highways was made but in actual practice, no roads have been sanctioned by the Central Government against these 70 announced National Highways.

• The previous State Government failed to get adequate Central Assistance for the two rail lines: Bhanupalli-Bilaspur and Chandigarh-Baddi.

• The previous State Government incurred expenditure of over Rs.27 crore on the HP Global Investor meets and two ground breaking ceremonies. The Global Investor Meets did not meet the desired objectives.

• Over 900 new institutions were opened haphazardly in last 6 months of the previous Government which increased the financial burden on the State.

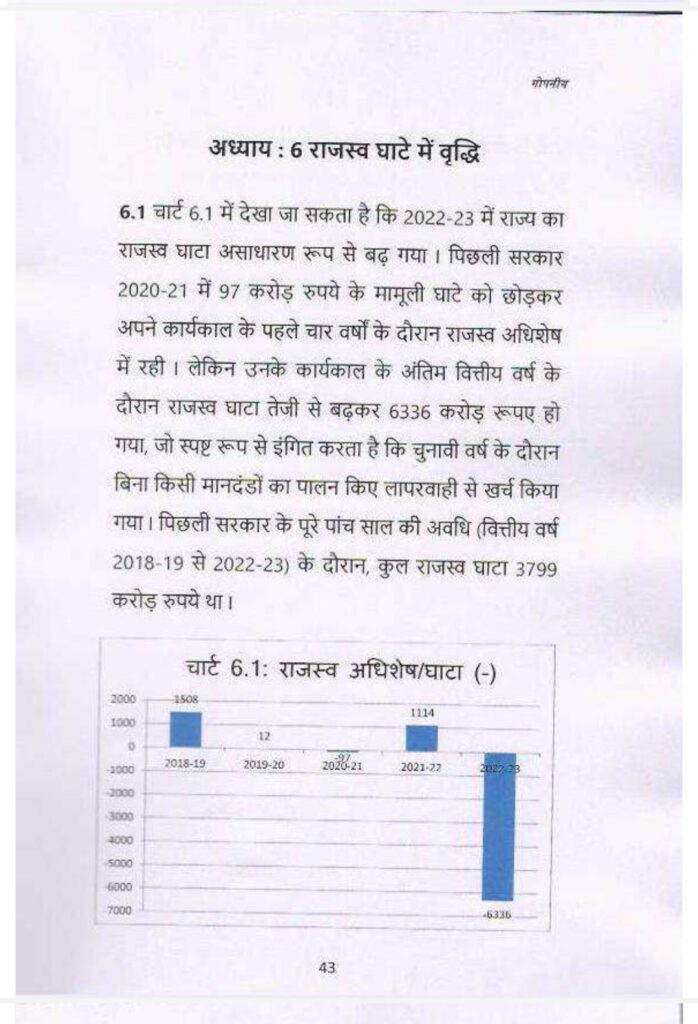

• During the last financial year of previous government, Revenue deficit increased sharply to Rs.6336 crore which indicates that expenditure was incurred recklessly during the election year without following any norms.

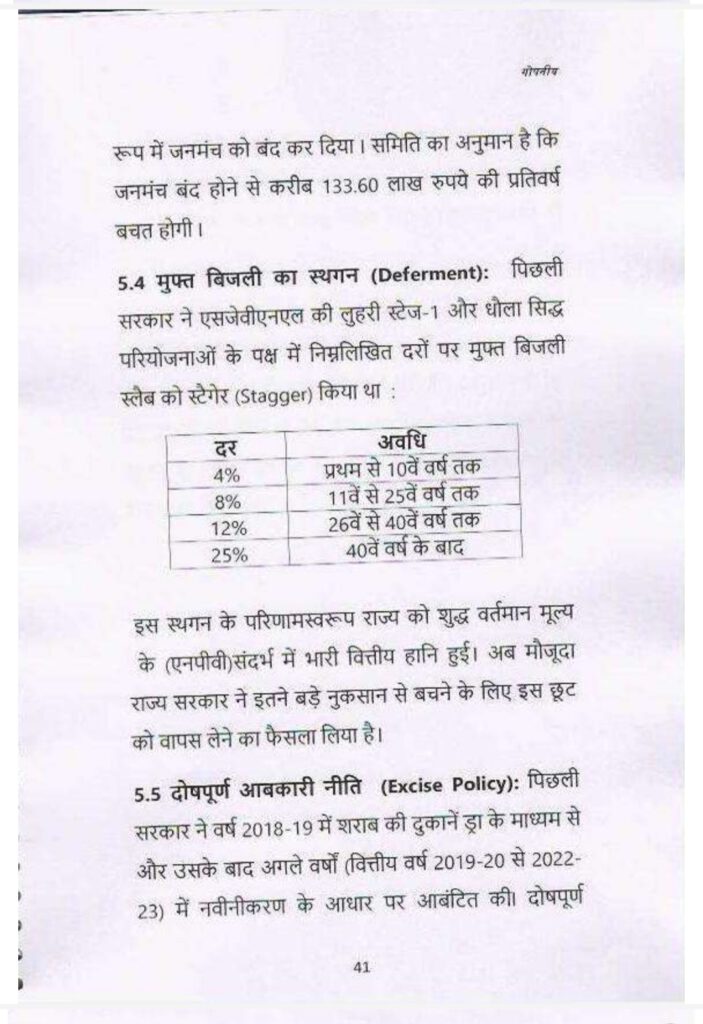

• Staggering of free power slabs on account of Luhri Stage-I and Dhaula Sidh projects of SJVN also resulted in huge financial loss to the State.

• The previous Government allotted liquor vends in the year 2018-19 by way of draw of lots and thereafter on renewal basis in the subsequent years. Due to defective excise policy, revenue of the State Government under this head increased only by Rs.665.41 crore in four years [2019-20 to 2022-23].

• The present Congress Government has adopted new excise policy for the year 2023-24 and it is estimated that there will be an overall increase of Rs.560.92 crore in revenue in the year 2023-24 as compared to actual revenue under this head in 2022-23.

• Present Government is taking landmark initiatives to improve the financial situation of the state and take it on the path to long term sustainable development of the state.